|

|

Order by Related

- New Release

- Rate

Results in Title For free federal tax forms

| Federal Money Retriever .. |

|

| Itemize deductions with ease. ..

|

|

| You don't have to be a tax expert to prepare your own taxes with TaxCut from H&R Block. A step-by-step interview identifies new tax breaks you can use, tells you which forms you need, performs the calculations, and checks your return for common errors and potential IRS audit flags. Download now for a FREE trial run to see how TaxCut Deluxe can help you! When you're ready to print or e-file your return, it's easy to order the full version of TaxCut Deluxe and import the work you've already completed! take control of your tax prep with great speed, ease, and accuracy using TaxCut from H&R Block, the #1 rated do-it-yourself tax software* on the market. .. |

|

| I wrote this program for people who like to browse catalogs and such, figuring out different prices and totals before they go shopping. This program will help you calculate the cost of any number if items, and add the tax automatically. See how much more that new computer is going to cost you when you get to the checkout. Selectable tax rates, optional Sound and ToolTips. EASY to ..

|

|

| WinTax is a free Canadian payroll tax calculator available starting for the year 2002. WinTax is similar to WinTOD, which is a product issued by Canada Customs and Revenue Agency. Both programs provide users with an easy way to calculate taxes on regular salary, bonus, retroactive pay and commission. Calculations include CPP, EI, Federal tax and Provincial tax (including Quebec). .. |

|

| Taxes stressing you out? Feel better by smacking around our virtual accountant. The more he takes out of your pocket the better you will feel after a good throwdown. ..

|

|

| Solve a fun and challenging race car puzzle. Complete the puzzle to win. .. |

|

| Delinquent tax returns? You need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you are a IRS non-filer, don't wait another minute; delay could cost you your freedom.

Even if you believe that you have paid all the taxes you owe through withholding, or by your employer, the willful failure to file a return is a criminal offense. The best way to avoid criminal prosecution relating to late tax returns is to remedy the situation voluntarily and submit all unfiled tax returns. The IRS is far less likely to pursue a criminal prosecution if you take the first steps in resolving the issue and get all delinquent tax returns filed.

The InfoNowBrowser (tm) is a self-contained secure method of delivering text, video and audio information.

www.4taxhero.com .. |

|

| This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2008. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total income. .. |

|

| Non-filers of late tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you have delinquent tax returns, don .. |

|

Results in Keywords For free federal tax forms

| Comfortable and free way to preview the fonts installed on your system... |

|

| Have you got lots of fonts to choose from? Do you get annoyed every time you pick a font for a fancy birthday card or a web page logo because all the software you have is only capable of showing one font at a time? Help is at hand. Free&Easy Font Viewer gives you the opportunity to view all your installed fonts simultaneously.

This tool definitely lives up to its name: it is both free and easy. Free&Easy Font Viewer shows you all the installed fonts (that is, those that are in the Fonts folder in your Control Panel) in one window. You can scale the fonts up and down and check out how they look in different font styles (bold, italic, underline, strike through)...

|

|

| Federal Money Retriever.. |

|

| Inmate Search - Locate Prisoner Records. Search Federal & State/County Prisons. This powerful tool provides access to federal & state inmate databases. Find current inmates, and find out if someone has been incarcerated or if they've been to federal prison in the past.

Your public inmate records search is 100% legal and discreet. Download now to begin your search!..

|

|

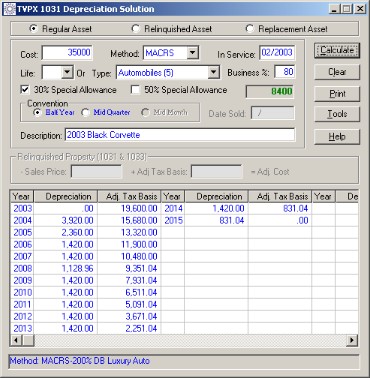

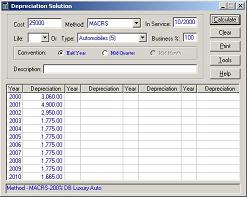

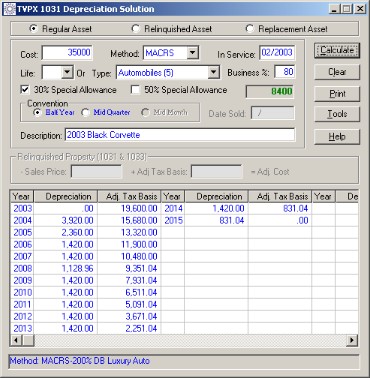

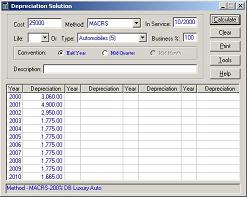

| TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format. By filling in a few fields, the user can quickly produce a depreciation schedule for a fixed asset.

TVPX 1003 Depreciation Features

Calculate the adjusted tax basis of replacement property purchased as part of a Like-Kind Exchange under IRS Section 1031.

This is an ideal application for a CPA, or anyone doing taxes, justifying capital purchases, or manually booking depreciation.

A formal depreciation schedule can be printed for an asset.

Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements.

Extensive on-line help details methods and tax requirements.

Automobile and 179 limits can be input to stay current with changing tax regulations.

Calculates Luxury Automobile Depreciation... |

|

| This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2008. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total income...

|

|

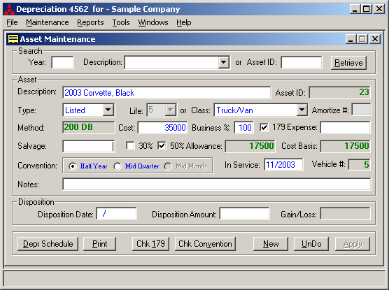

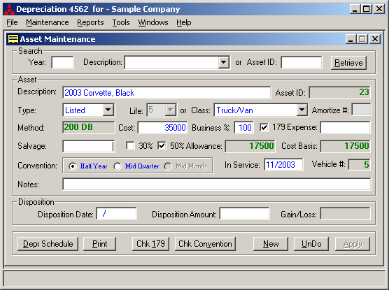

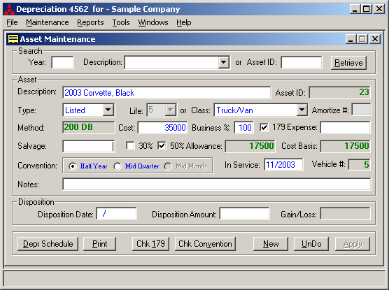

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line.. |

|

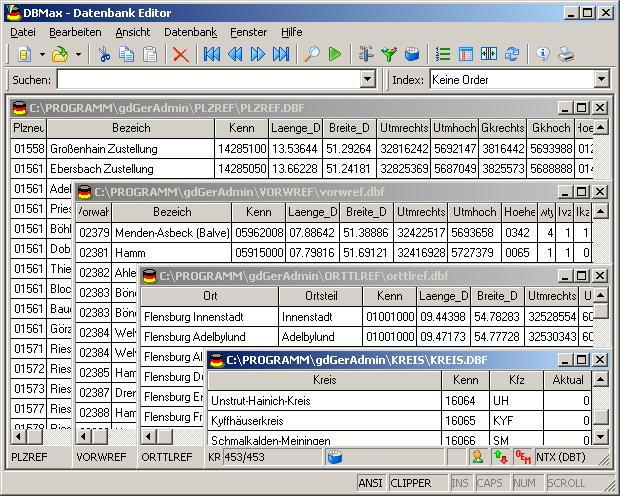

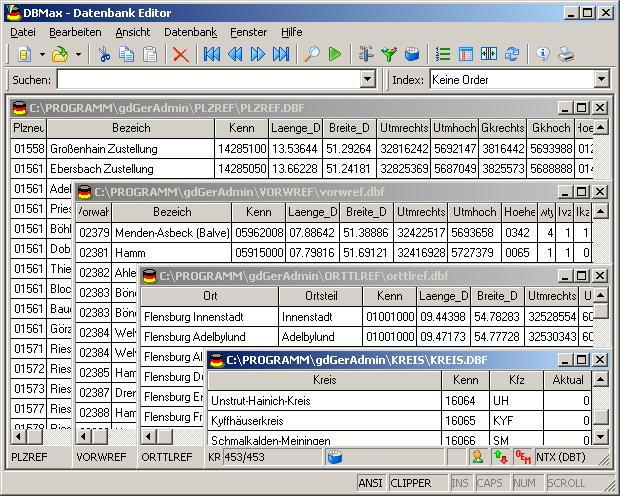

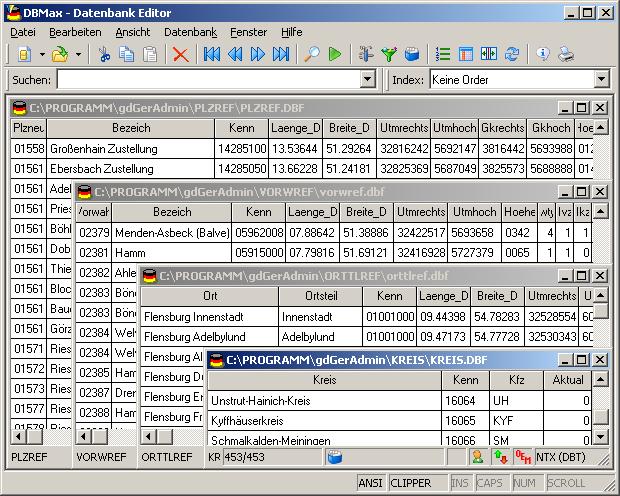

| The database contain geodata of the Federal Republic of Germany with geo referenced towns, municipalities, town quarters, administrative units, postal codes, telephone preselections, nature areas, landscapes, climatic zones for proximity searches ec... |

|

| The database contain geodata of the Federal Republic of Germany with geo referenced towns, municipalities, town quarters, administrative units, postal codes, telephone preselections, nature areas, landscapes, climatic zones for proximity searches ec... |

|

| Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements. All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive on-line help details methods and tax requirements. This cost-effective software was designed to meet your business needs. You can create an unlimited number of companies and assets. Fixed Assets can be classified by asset type, class, general ledger account, or location. Detail information is tracked by asset. There are twelve standard reports, which can be preview or printed. Some of the features of Depreciation 4562 Pro Easy customization of asset classes simplifies asset input. Most reports can be produced for any period, historical or future. Supports fiscal years ending in any calendar month. Keeps track of Tax and Book depreciation. Multiple users are supported Unlimited FREE technical support is included. Supports an unlimited number of companies and assets. A Sample Company and data are included to reduce the learning curve. Auto calculation of accumulated depreciation to aid in conversion of assets from a different application. Depreciation is generated using IRS tax tables. Eight comprehensive tax reports are provided. Five standard Book reports are included. Produces monthly journal entry for book depreciation. New maximum automobile limits can be input to stay current with changing tax regulations. Backup Wizard makes it easy to backup valuable fixed asset data. Keeps track of assets by location. Maintains notes on each asset. A formal depreciation schedule can be printed. Compliant with all federal tax requirements... |

|

Results in Description For free federal tax forms

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data inf.. |

|

| Depreciation Solution is an extremely easy way to calculate Federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format. Extensive on line help details methods and tax requirements.New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month convention are provided. Depreciation is generated using IRS tax tables.This is an ideal application for a CPA, or anyone doing tax schedule 4562, justify capital purchases, or manually booking depreciation.The following depreciation methods are supported: ADS Amortization MACRS - 200 DB MACRS - 150 DB MACRS - Straight-Line Straight -Line ..

|

|

| Federal, State and Local withholding tax technology. ActiveX Dll that gives you up-to-date U.S. payroll withholding tax computation. .. |

|

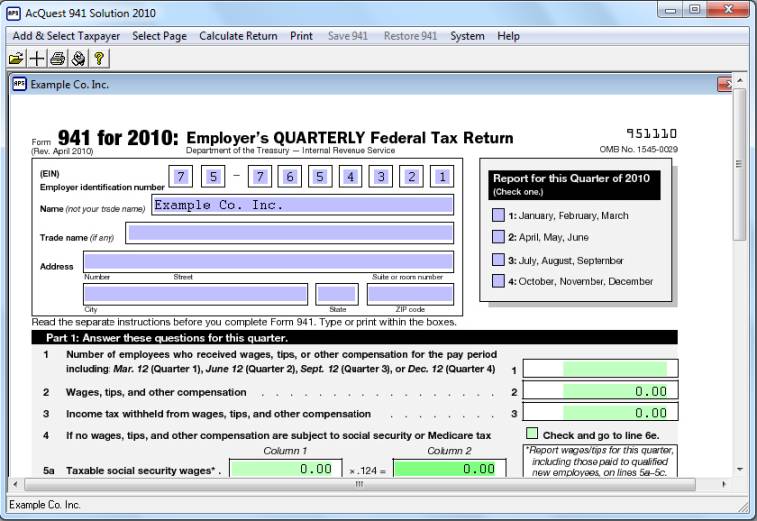

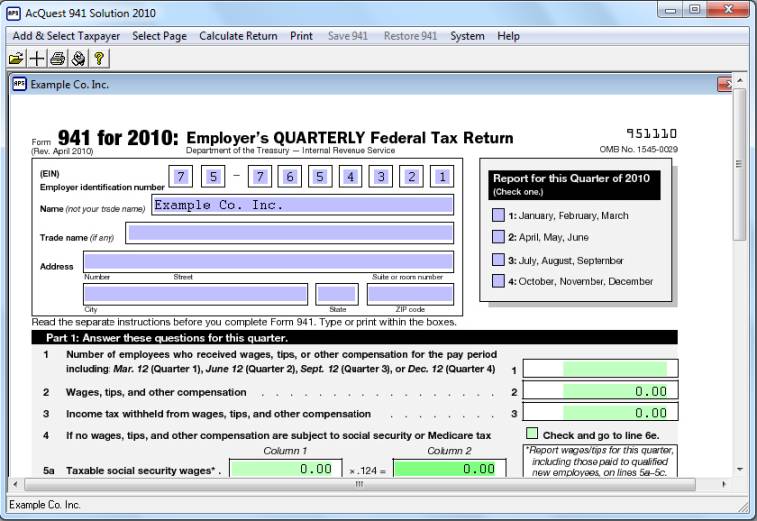

| AcQuest 941 Solution 2011. Windows XP, Vista, & Windows 7. Prepares federal Form 941, Employer`s Quarterly Federal Tax Return. With unregistered version, data can be printed but not saved...

|

|

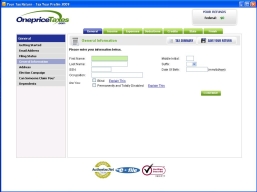

| OnePriceTaxes tax software allows you to file your individual federal and state income tax return with the IRS and your state all for the one low price of $19.95. Taxes hurt, filing shouldn't... |

|

| OnePriceTaxes tax software allows you to file your individual federal and state income tax return with the IRS and your state all for the one low price of $19.95. Taxes hurt, filing shouldn't...

|

|

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line.. |

|

| Tax Assistant for Excel is a custom application written for Microsoft Excel. It simplifies your Federal Income Tax preparation by providing Excel workbooks with IRS approved substitutes for both Form 1040, 1040A and related schedules.. |

|

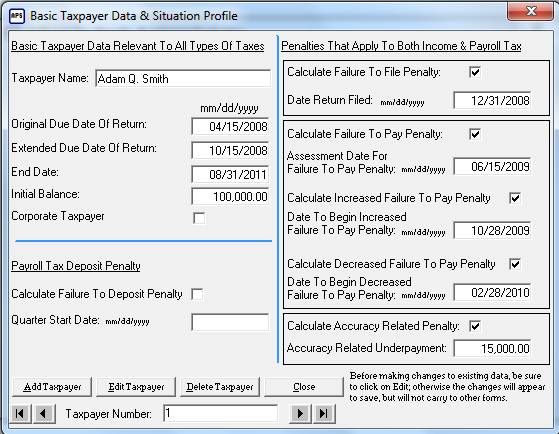

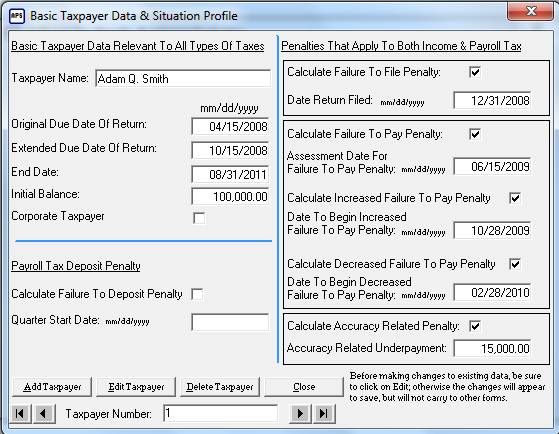

| AcQuest Tax Penalty & Interest Evaluator. Calculates and verifies federal tax penalties and interest for individuals, corporations and employers. Demo limited to 10 days or 5 uses. Win XP, Vista, & Windows 7... |

|

| Payroll Mate is easy to use, yet powerful payroll system. This payroll software supports multiple companies with multiple employees. Hourly, salaried, bonus, vacation, sick, other pay and unlimited number of user-defined income types. Unlimited number of user-defined deduction and tax types including taxable and allocated tips. Doing payroll is fast and easy with Payroll Mate payroll software. This payroll system automatically calculates net pay, federal withholding tax, Social Security tax, Medicare, state and local payroll taxes. Payroll Mate payroll program also prints checks, prepares payroll forms 941, 940, W2 and W3... |

|

Results in Tags For free federal tax forms

| You don't have to be a tax expert to prepare your own taxes with TaxCut from H&R Block. A step-by-step interview identifies new tax breaks you can use, tells you which forms you need, performs the calculations, and checks your return for common errors and potential IRS audit flags. Download now for a FREE trial run to see how TaxCut Deluxe can help you! When you're ready to print or e-file your return, it's easy to order the full version of TaxCut Deluxe and import the work you've already completed! take control of your tax prep with great speed, ease, and accuracy using TaxCut from H&R Block, the #1 rated do-it-yourself tax software* on the market... |

|

| Itemize deductions with ease...

|

|

| Tax Brackets Estimator is a tax planning tool. Tax Brackets Estimator displays your tax bracket, i.e. top tax percentage on the last dollar taxable income earned. The software includes tax information for year 2000-2005 and different filing status... |

|

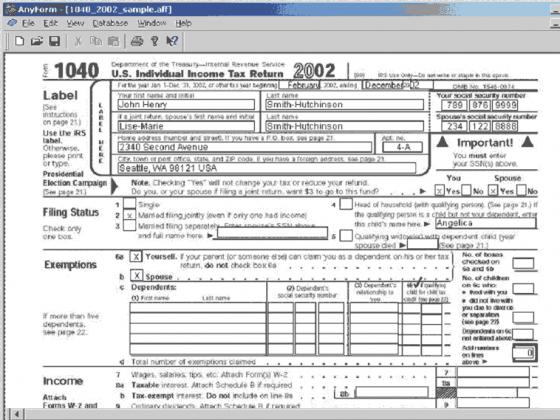

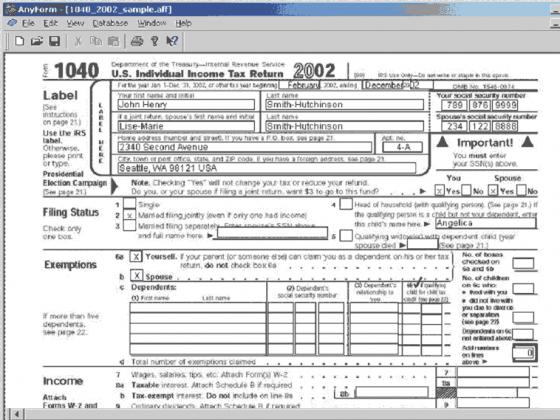

| Form software AnyForm..

|

|

| Tax Brackets Calculator displays tax brackets for federal income tax years 2000-2005, calculates you federal tax given your taxable income and estimates average tax rate... |

|

| This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2008. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total income...

|

|

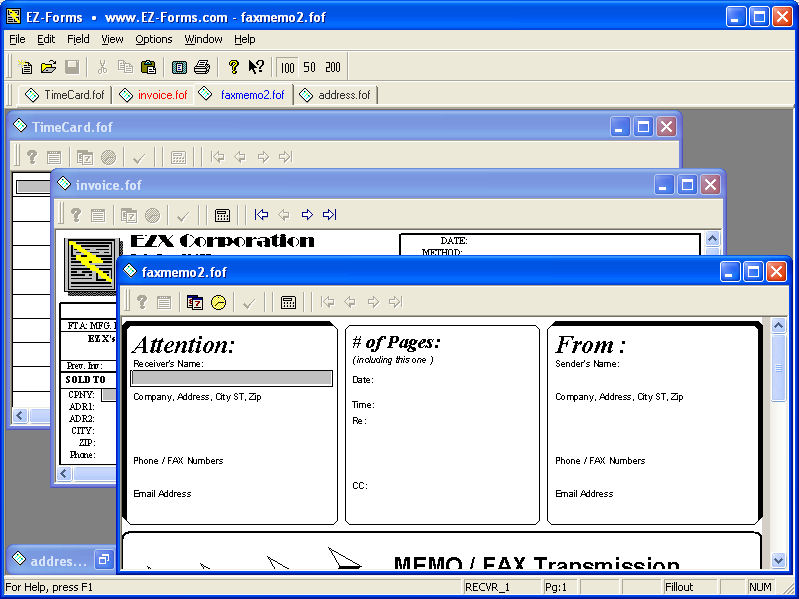

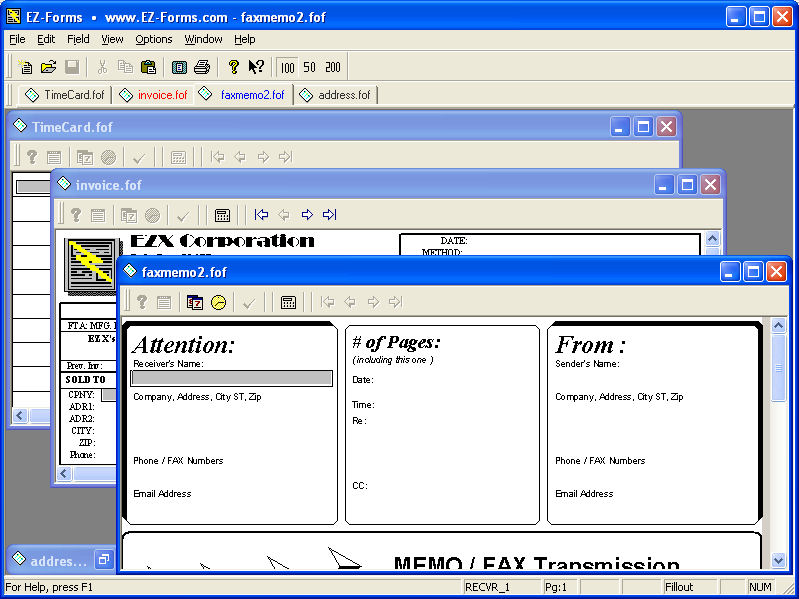

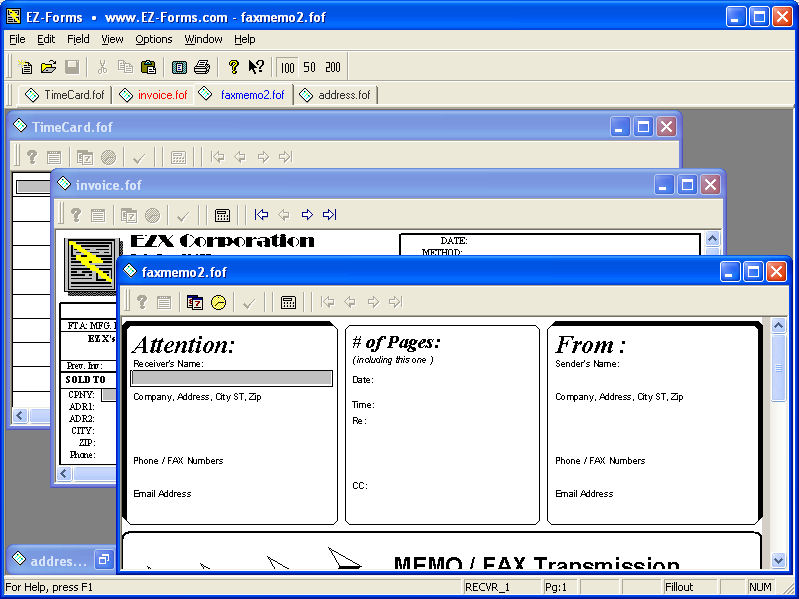

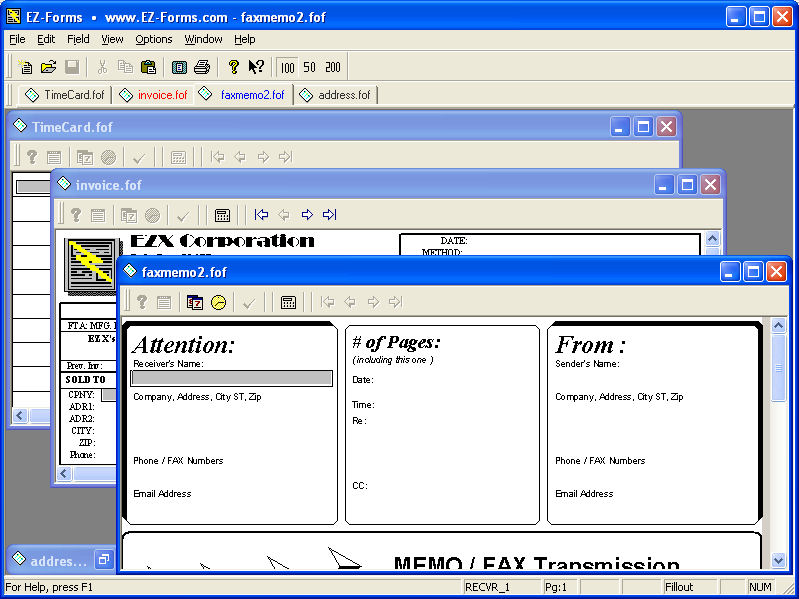

| As "EZ" as scan/import - point - click - insert/automate fields - go. Create Stand-alone electronic forms Pre-printed-form data-only overlay mode. Import PDFs (Acrobat), Bitmap Images Import/Export Data Encryption availabable Wizards make it EZ.. |

|

| TaxBrain Online Tax Software. The quick and smart way to handle your tax return. Best of all, it's convenient, easy-to-use, free to try and guaranteed accurate. TaxBrain Online handles IRS and all state tax filing... |

|

| - View, Print, Email, FAX (driver required), eforms (visual electronic forms) created with EZ-Forms ULTRA/EZ-Forms Designer. - Encryption enabled. (pw reqd.) - View web enabled eforms... |

|

| - View, Print, Email, FAX (driver required), eforms (visual electronic forms) created with EZ-Forms PRO Designer. - Encryption enabled. (pw reqd.) - View web enabled eforms... |

|

Related search : federal state efiledeluxe federal stateturbotax deluxe federalbrackets estimatortax brackets,tax brackets estimator,original paper formodbc supported databaseimporting data fromtax bracketscalculator 2005brackets calculator,brackets calculator 2005taOrder by Related

- New Release

- Rate

federal tax forms 2007 -

federal tax forms 2010 -

federal tax forms 2012 -

federal tax return forms -

free federal tax return -

|

|